The equilibrium price computation will follow the same volume maximization logic based on aggregated demand & supply of orders, which is currently followed for the existing pre-open session. All orders entered in the system should match at the same price, i.e. the equilibrium price, if they qualify as match-able. Once price is discovered during special Pre-open session, the scrip will move to continuous trading session.

- Duration of special Pre-open session - 60 minutes from 9:00am - 10.00am

- This Pre-Open session will be conducted only on first day of trading (in case of IPOs) and recommencement of trading (in case of re-listed Securities).

- All executable orders for a particular stock will match at the equilibrium price which will be the market opening price.

- Orders are collected in the order entry period & execution occurs in the order matching period.

- Only Limit Orders are accepted (including limit IOC orders). No market orders will be allowed.

- All orders shall be disclosed in full quantity, i.e. orders where revealed quantity function is enabled, will not be allowed during the pre-open session.

- Indicative opening price & matchable quantity for the stock will be disseminated at regular intervals of order entry period.

- Block deal session will not be held for participating Securities on first day of trading\recommencement till 1st day of order matching & resultant price discovery. However Securities will be enabled for the regular block deal session from the next trading day onwards after price discovery.

-

In case of no price discovery in special pre- open session -

IPO Securities: All orders entered will move to continuous trading session at their limit price on price-time priority

Relisted stocks: All orders will be CANCELLED by the system and the Security shall continue to trade in call auction mechanism until price is discovered - Relisted stocks and IPOs with issue size less than 250Cr will be traded in TFT (Trade for Trade) segment for first 10 days.

- No Price band will be applicable for IPOs and Relisted stocks in the special Pre-Open Session.

Special Pre-open session shall comprise of two sessions viz.

- Order Entry period.

-

Order Matching period.

After order matching period there are buffer period to facilitate transition between preopen and continuous session

- The order entry period is defined as the timing of Special preopen session. 9.45* minutes shall be provided for order entry, modification and cancellation. (* - System driven random stoppage between 9.35th and 9.45th minute)

- Only Limit order will be allowed.

- Dissemination of indicative equilibrium price, indicative match-able quantity & indicative index values.

Order Matching Period

-

Order matching period will start immediately after completion of order entry period.

• Order Addition/Modification will not be allowed and Order Cancellation will be allowed - Opening price determination and trade confirmation.

- The continuous trading session for the set of Securities participating in the special pre-open session will immediately commence after the new pre-open session ends and subject to certain conditions after price discovery. The two sessions, continuous and the special pre-open will not run concurrently for the above-mentioned set of Securities.

- In case of Relisted Securities, system will schedule another round of special pre-open session if equilibrium price is not discovered.

-

Equilibrium Price Discovery: The equilibrium price computation should follow the same volume maximization logic based on aggregated demand & supply of orders, which is currently followed for the existing pre-open session. All orders entered in the system should match at the same price, i.e. the equilibrium price, if they qualify as match-able.

Opening price determination logic for IPO's and Relisted Securities

The following steps illustrate the detailed process to calculate the opening price.

Step 1: Sorting and Aggregating Orders at Different Price Points

All limit orders in the order book will be organized in the following manner:

- Consider the limit order price points at and within the range of the highest buy price and lowest sell price. Arrange the limit order price points in descending order.

-

Calculate the cumulative buy and sell quantity at each price point. Cumulative buy quantity shall increase or remain constant as the price decreases. Cumulative sell quantity shall decrease or remain constant as the price decreases.

Step 2: Determining the Maximum Tradable Quantity

The tradable quantity at an eligible price point is the minimum of the cumulative buy quantity and cumulative sell quantity at that price point. The price point, at which the tradable quantity is maximum, is considered the opening price. If there is a single price point at which the quantity traded is maximum then that is the opening price.

If there are multiple price points with the same traded quantity, we proceed to the next step.

Step 3: Establishing Order Imbalance

The order imbalance is calculated as the difference between the cumulative buy quantity and cumulative sell quantity at each eligible price point. If there is a single volume maximizing price at which the absolute unfilled/unmatched quantity (order imbalance) is minimum that price is the opening price.

If there is multiple volume maximizing prices at which the order imbalance is minimum, then we proceed to the next step.

Step 4: Comparing with the close Price

To arrive at the final price we choose the potential price (obtained from the previous steps) which is closest to the close price. This single price point is chosen as final opening price at which all orders are executed. In case the close price is the mid value of a pair of prices which are closest to it, then the close price itself will be considered the market opening price.

-

Treatment of Unmatched orders

-

IPO Securities:

- All unmatched limit orders in the special pre-open session will be shifted to the order book of the continuous trading session at their limit price on price-time priority basis, irrespective of whether the equilibrium price has been discovered or not.

- In case the limit price of any unmatched order that is shifted to the continuous trading session is beyond the applicable price band for that Security, then such outstanding orders shall be returned to the respective member.

- Unmatched orders entered with IOC will get rejected.

-

Re-listed Securities:

- Equilibrium price discovered: All unmatched orders entered during the pre-open (Call Auction) period shall be moved to the continuous trading session at their limit price.

- Equilibrium price NOT discovered: All orders will be CANCELLED by the system at the end of the special pre-open session.

-

IPO Securities:

The following information will be disseminated to the market at regular intervals during the order entry period pre-open session -

- Indicative market opening price, populated in the 'LTP' field

- Matchable quantity at the indicative market opening price, populated in the 'LTQ' field

If the indicative open price/matchable quantity at the indicative open price is not available then the 'LTP'/'LTQ' field is right blank.

- Total buy /sell depth of the book will be populated in the 'Buy /Sell depth' fields

- Percentage change in the indicative price

- High/ Low prices will be disseminated based on the indicative opening prices

- The 'open' field in the BOLT system will be populated only when the actual opening price has been determined in the order matching and confirmation period.

- The 'Close' field will display issue price in case of IPO

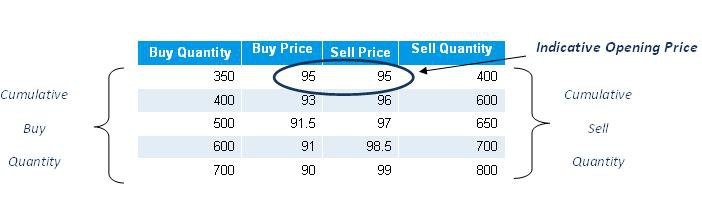

The market depth would display:

- Indicative opening price with next best 4 bids and offers. If the indicative opening price is not determined, then the best bids and offers will be displayed

- Cumulative quantities at each of these price points

|

Demand Supply Schedule

|

Here the opening price determined is 95.00 at which the tradable quantity is maximized. The market depth display would be as follows:

| 1. | Q. | What are the stocks that will be traded in Special Pre-open session? | |||||

| A. | IPOs and Re-listed Securities will be traded in the Special Pre-open session only on the first day of their trading (in case of IPOs) and recommencement of trading (in case of re-listed Securities) | ||||||

| 2. | Q. | What will be the timings of Call Auction special Pre-Open Session? When will the continuous trading session start? | |||||

| A. |

Special Pre-open session shall comprise of two sessions viz.

Order Matching Period

|

||||||

| 3. | Q. | When will the Block deal session start? | |||||

| A. |

For New listing i.e. for IPO securities the afternoon block deal window shall be applicable and for Relist security, the afternoon block deal window shall be applicable, subject to price discovery in the special pre-open session (SPOS). The Block Reference price for afternoon window i.e. VWAP of trades between 1.45 pm to 2.00 pm shall be applicable for new listing and Relist securities. If no trades are executed between 01:45 PM to 02:00 PM then the reference price shall be the discovered price at which the security was listed/relisted. |

||||||

| 4. | Q. | How will the trading process work during the pre-open session? | |||||

| A. | The order entry period will last for 45 minutes during which orders can be entered, modified and cancelled. This period will close randomly during the last one minute (between 9.35th and 9.45th minute). Random stoppage will be system driven. The next step is the order matching and confirmation period which will last for 10 minutes during which the opening price will be determined and disseminated and trades will be executed. The last 5 minutes will be the buffer period before the start of the continuous trading session. | ||||||

| 5. | Q. | What order types are accepted in this segment? | |||||

| A. | Only Limit orders are accepted including limit IOC orders. | ||||||

| 6. | Q. | How will the market opening price of a stock be determined during the Special Pre-open session? | |||||

| A. | It would be same as existing pre-open session. Opening Price would be determined as per the Volume maximization logic. | ||||||

| 7. | Q. | What will be the Equilibrium price if there is single price at which order imbalance is minimum for both IPOs and Re-listed Securities? | |||||

| A. | System will consider equilibrium price as that price at which order imbalance is minimum. | ||||||

| 8. | Q. | What will be the Equilibrium price if there are multiple prices at which order imbalance is same (minimum) for both IPOs and Re-listed Securities? | |||||

| A. | System will consider price closest to the close price if there are multiple price with minimum imbalance. | ||||||

| 9. | Q. | What happens if price is not discovered? | |||||

| A. |

|

||||||

| 10. | Q. | In case of Re-listed Securities if price is not discovered then when new call auction session will start? | |||||

| A. |

In case of Re-listed Securities , if price is not discovered then another special pre-open session will start. This will happen till price is not discovered. |

||||||

| 11. | Q. | What will happen to the unmatched orders? | |||||

| A. |

IPO Securities :

|

||||||

| 12. | Q. | Will there be any indicator on BOLT TWS for IPOs & Re-listed Securities? | |||||

| A. |

Market depth window of BOLT TWS will have following indicator on title bar for IPO & Re-listed Securities.

|

||||||

| 13. | Q. | How can a user set up the Market watch for IPO/ Re-listed Securities on Touchline? | |||||

| A. |

BOLT TWS will generate a SPR file in BOLTNTSBT folder at the time of downloading latest Security master. This SPR file will contain securities for IPO & Re-listed Securities on that trading day. The BOLTNTSBT folder shall always have two files available with naming convention as mentioned below - IPORelist_ddmmyyyy_c : For current day file IPORelist_ddmmyyyy_p : For previous day file Date of SPR file will be shown as date of Security master generation. User can set up market watch by uploading that SPR file through Security profile window to display Securities under special Pre- open session in Touchline. |

||||||

| 14. | Q. | Are margins applicable during the pre-open session? | |||||

| A. |

IPO:

|

||||||

| 15. | Q. | What are the Price bands applicable for IPO and Re-listed Securities in continuous session? | |||||

| A. |

| ||||||

| 16. | Q. | Price Limits for securities under Call Auction Trading during Special Pre-open Session (SPOS)? | |||||

| A. | 'Price Limits for Securities under SPOS' | ||||||

| 17. | Q. | Whether any additional data is being shared as part of SPOS session? | |||||

| A. | User can view total number of Cancelled orders & Cancelled Qty (both Buy and Sell Side) on BSE website and trading terminal during Order entry period of SPOS session. | ||||||

|

|

Setting up of Market watch for IPO/ Re-listed Securities on Touchline:

BOLT TWS will generate a SPR file in BOLTNTSBT folder at the time of downloading latest Security master. This SPR file will contain securities for IPO & Re-listed Securities on that trading day. The BOLTNTSBT folder shall always have two files available with naming convention as mentioned below -

IPORelist_ddmmyyyy_c: For current day file

IPORelist_ddmmyyyy_p: For previous day file

Date of SPR file will be shown as date of Security master generation. This file can be loaded through Security profile window to display Securities under special Pre- opening session on that day in Touchline.

In addition to this, current market depth window will have following indicator on title bar for IPO & Re-listed Securities.

- SPOS-IPO (For IPO securities)

- SPOS-Relist (For Relist securities)

White paper on BSE SME

In this paper, we look at the BSE-SME footprint since 2012 and its growth till date. We also look at the reach of BSE SME, the value creation it has from investors perspectives and the option of capital formation from the SME perspective.

Attention Investors

Leagues/Schemes/Competitions Offered

by Third Party or Group Company

of Stock Broker

BSE is issuing this Investor Alert to warn

investors about leagues/schemes/

competitions etc (hereinafter referred

to as "schemes") offered by third party

or group company /associate of stock

broker, which may involve distribution

of prize monies....

New BSEIndia Android App

Now keep abreast with the happenings of the stock market on your Android Phone.