|

Order

Book

|

| 1 |

100 |

ATO |

91 |

100 |

7 |

| 2 |

100 |

96 |

91.5 |

100 |

8 |

| 3 |

150 |

95 |

93 |

100 |

9 |

| 4 |

50 |

93 |

95 |

100 |

10 |

| 5 |

100 |

91.5 |

96 |

200 |

11 |

| 6 |

100 |

91 |

|

|

|

|

|

|

|

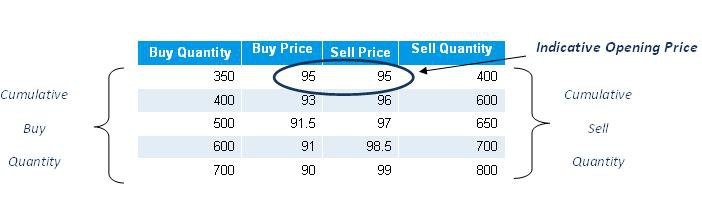

Demand

Supply Schedule:

|

| 96.00 |

200 |

600 |

200 |

| 95.00 |

350 |

400 |

350 |

| 93.00 |

400 |

300 |

300 |

| 91.50 |

500 |

200 |

200 |

| 91.00 |

600 |

100 |

100 |

| |

|

The opening price is determined at 95, where the tradable quantity

is maximum at 350 units

|

|

Matching

of Orders:

|

| 2 |

7 |

100 |

| 3 |

8 |

100 |

| 3 |

9 |

50 |

| 1 |

9 |

50 |

| 1 |

10 |

50 |

| |

|

|

|

Pending

Orders:

|

| 4 |

50 |

93 |

95 |

50 |

10 |

| 5 |

100 |

91.5 |

96 |

200 |

11 |

| 6 |

100 |

95 |

91 |

|

|

| |

|

|

Order

Book:

|

| 1 |

1000 |

ATO |

ATO |

500 |

7 |

| 2 |

1000 |

96.30 |

94.00 |

500 |

8 |

| 3 |

3000 |

96.20 |

96.20 |

1000 |

9 |

| 4 |

1500 |

94.00 |

96.30 |

3500 |

10 |

| 5 |

2000 |

92.00 |

98.00 |

3000 |

11 |

| 6 |

1000 |

90.00 |

|

|

|

| |

|

|

|

Demand

Supply Schedule:

|

| 98.00 |

1000 |

8500 |

1000 |

|

| 96.30 |

2000 |

5500 |

2000 |

3500 |

| 96.20 |

5000 |

2000 |

2000 |

3000 |

| 94.00 |

6500 |

1000 |

1000 |

|

| 92.00 |

8500 |

500 |

500 |

|

| 90.00 |

9500 |

500 |

500 |

|

| |

|

|

Matching

of Orders:

|

| 2 |

8 |

500 |

| 2 |

9 |

500 |

| 3 |

9 |

500 |

| 3 |

7 |

500 |

| |

|

|

|

Pending

Orders:

|

| 1 |

1000 |

96.20(market

carried forward as

limit at the opening price)

|

96.30 |

3500 |

10 |

| 3 |

2000 |

96.20 |

98.00 |

3000 |

11 |

| 4 |

1500 |

94 |

|

|

|

| 5 |

2000 |

92 |

|

|

|

| 6 |

1000 |

90 |

|

|

|

| |

|

|

Order Book:

|

|

1

|

1000

|

ATO

|

ATO

|

500

|

7

|

|

2

|

1000

|

96.30

|

94.00

|

500

|

8

|

|

3

|

3000

|

96.20

|

96.20

|

1000

|

9

|

|

4

|

1500

|

94.00

|

96.30

|

3000

|

10

|

|

5

|

2000

|

92.00

|

98.00

|

3000

|

11

|

|

6

|

1000

|

90.00

|

|

|

|

|

|

|

Demand Supply Schedule:

|

|

98.00

|

1000

|

8000

|

1000

|

|

|

96.30

|

2000

|

5000

|

2000

|

3000

|

|

96.20

|

5000

|

2000

|

2000

|

3000

|

|

94.00

|

6500

|

1000

|

1000

|

|

|

92.00

|

8500

|

500

|

500

|

|

|

90.00

|

9500

|

500

|

500

|

|

|

Here at price points 96.20 and 96.30 the

tradable quantity is maximum and the absolute order imbalance is minimum.

We therefore reference the previous closing price to arrive at the final

opening price.

3 a) if previous close is 96.50, then the opening price will be 96.30

|

|

Matching of Orders:

|

|

2

|

8

|

500

|

|

2

|

9

|

500

|

|

1

|

9

|

500

|

|

1

|

10

|

500

|

| |

|

|

|

Pending Orders:

|

|

3

|

3000

|

96.20

|

96.30(Market carried forward as Limit at the opening price)

|

500

|

7

|

|

4

|

1500

|

94.00

|

96.30

|

2500

|

10

|

|

5

|

2000

|

92.00

|

98.00

|

3000

|

11

|

|

6

|

1000

|

90.00

|

|

|

|

| |

|

|

Matching of Orders:

|

|

2

|

8

|

500

|

|

2

|

9

|

500

|

|

3

|

9

|

500

|

|

3

|

7

|

500

|

| |

|

|

|

Pending Orders:

|

|

1

|

1000

|

96.20(Market carried forward as Limit at the opening price)

|

96.30

|

3000

|

10

|

|

3

|

2000

|

96.25

|

98.00

|

3000

|

11

|

|

4

|

1500

|

94.00

|

|

|

|

|

5

|

2000

|

92.00

|

|

|

|

|

6

|

1000

|

90.00

|

|

|

|

|

|

|

|

3 c) If Previous Close is 96.25- which is exactly between

the potential opening prices, then the opening price will be 96.25

|

|

Matching of Orders:

|

|

2

|

8

|

500

|

|

2

|

9

|

500

|

|

1

|

9

|

500

|

|

1

|

7

|

500

|

|

|

|

Pending Orders:

|

|

3

|

3000

|

96.20

|

96.30

|

3000

|

10

|

|

4

|

1500

|

94.00

|

98.00

|

3000

|

11

|

|

5

|

2000

|

92.00

|

|

|

|

|

6

|

1000

|

90.00

|

|

|

|

| |

|

|

Example 4: If there are only market orders on sell

side of the order book

|

|

Order Book

|

|

1

|

100

|

ATO

|

ATO

|

100

|

6

|

|

2

|

50

|

95

|

ATO

|

50

|

7

|

|

3

|

100

|

94

|

ATO

|

50

|

8

|

|

4

|

100

|

93

|

|

|

|

|

5

|

200

|

92

|

|

|

|

|

|

|

Demand Supply Schedule:

|

|

95.00

|

150

|

200

|

150

|

|

|

94.00

|

250

|

200

|

200

|

50

|

|

93.00

|

350

|

200

|

200

|

150

|

|

92.00

|

550

|

200

|

200

|

350

|

| |

|

The Opening Price is determined at 94.00

at which the tradable quantity is maximum and the absolute order imbalance

is minimum

|

|

Matching of Orders:

|

|

2

|

6

|

50

|

|

3

|

6

|

50

|

|

3

|

7

|

50

|

|

1

|

8

|

50

|

|

1

|

10

|

50

|

|

|

|

|

|

Pending Orders:

|

|

1

|

50

|

94(Market order carried forward as limit at opening price)

|

|

|

|

|

4

|

100

|

93

|

|

|

|

|

5

|

200

|

92

|

|

|

|

| |

|

|

Example 5: If there are only market orders on the

buy side of the order book

|

|

Order Book

|

|

1

|

100

|

ATO

|

200

|

ATO

|

5

|

|

2

|

150

|

ATO

|

100

|

92

|

6

|

|

3

|

50

|

ATO

|

100

|

93

|

7

|

|

4

|

100

|

ATO

|

150

|

94

|

8

|

|

|

|

|

100

|

95

|

9

|

| |

|

|

|

Demand Supply Schedule:

|

|

95.00

|

400

|

650

|

400

|

250

|

|

94.00

|

400

|

550

|

400

|

150

|

|

93.00

|

400

|

400

|

400

|

0

|

|

92.00

|

400

|

300

|

300

|

100

|

|

|

| |

|

The opening price determined is 93.00, where

the tradable quantity is maximum and the absolute order imbalance is minimum

|

|

Matching of Orders:

|

|

1

|

6

|

100

|

|

2

|

7

|

100

|

|

2

|

5

|

50

|

|

3

|

5

|

50

|

|

4

|

5

|

100

|

|

|

|

|

|

Pending Orders:

|

|

|

|

|

150

|

94

|

8

|

|

|

|

|

100

|

95

|

9

|

|

|

|

|

|

|

|

| |

|

|

Example 6: If there are only market orders in the

order book

|

|

Order Book

|

|

1

|

50

|

|

|

50

|

5

|

|

2

|

100

|

|

|

150

|

7

|

|

3

|

50

|

|

|

100

|

7

|

|

4

|

100

|

|

|

150

|

8

|

|

|

|

In case there are only market orders in the order book then matching

will occur at the previous closing price and all unexecuted orders will

be shifted to the order book of the continuous market as limit orders priced

at the previous day's closing price.

Let the previous day's closing price be 100

|

|

Matching of Orders:

|

|

1

|

5

|

50

|

|

2

|

6

|

100

|

|

3

|

6

|

50

|

|

4

|

7

|

100

|

|

4

|

5

|

100

|

|

|

|

|

|

Pending Orders:

|

|

|

|

|

100( Market carried forward as limit at previous day's close

|

150

|

8

|

| |

|

|

Example 7: No matchable quantity exists

|

|

Order Book

|

|

1

|

100

|

95

|

97

|

50

|

7

|

|

2

|

100

|

95

|

98

|

150

|

8

|

|

4

|

200

|

94

|

99

|

100

|

9

|

|

6

|

150

|

92

|

|

|

|

|

|

|

Here there is no overlap in the buy and the sell prices. All the sell prices are

greater than the buy prices. No matching is possible in this scenario. All Orders

will be shifted to the order book of the continuous trading session following price

time priority.

|

|

Pending Orders:

|

|

1

|

100

|

95

|

97

|

50

|

7

|

|

2

|

100

|

95

|

98

|

150

|

8

|

|

4

|

200

|

94

|

99

|

100

|

9

|

|

5

|

100

|

93

|

100

|

100

|

10

|

|

6

|

150

|

92

|

|

|

|

|

|

|

|

The opening price will be the price of the first trade executed during the continuous

session

|

|

|

|